Investors

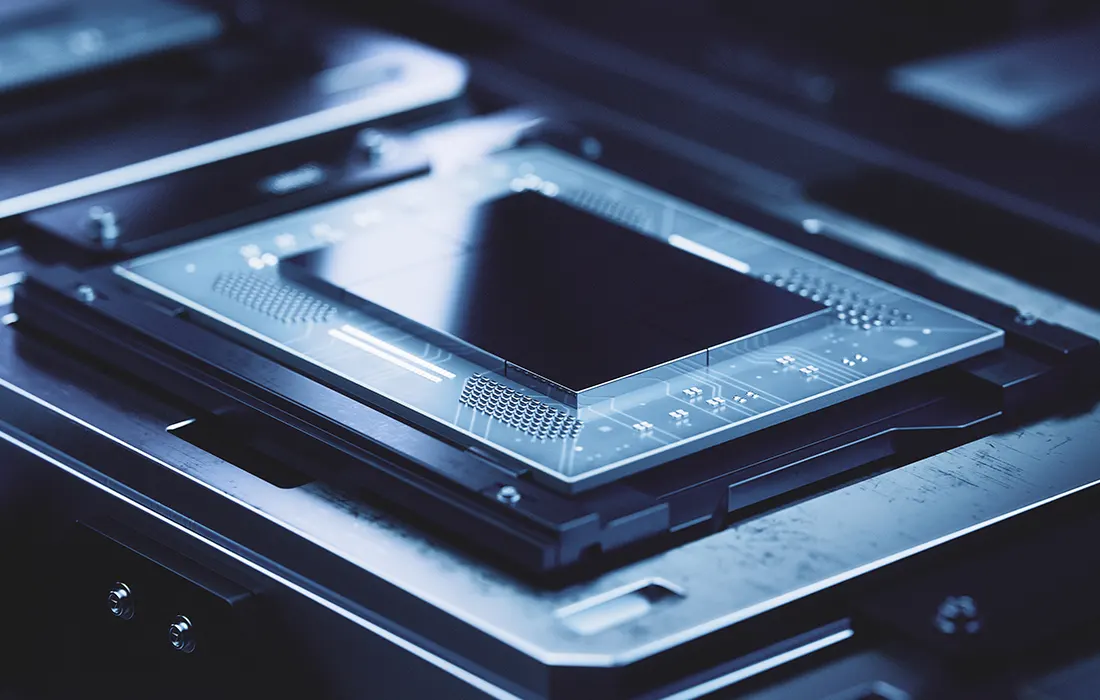

AT&S is a leading global manufacturer of high-quality IC substrates and printed circuit boards as well as a developer of pioneering interconnect technologies for the core areas of mobile devices, automotive & aerospace, industrial, medical and high-performance processors for VR and AI applications. AT&S has a global presence with production sites in Austria (Leoben, Fehring) and plants in India (Nanjangud), China (Shanghai, Chongqing) and Korea (Ansan near Seoul). A new high-end production facility for IC substrates is currently being ramped up in Kulim, Malaysia. A European competence center with connected series production for IC substrate technologies is being built in Leoben. Both sites will start production in the financial year 2024/25. The company currently employs more than 13,500 people.

Leading Player with Above-average Growth

A Look into the Future

FY 26/27 – Positive effects resulting from the projects in Austria and Malaysia

Growth

- Revenue of approximately € 3.1 billion (CAGR +26%)

Profitability

- EBITDA margin of 27 – 32%

- ROCE of >12% from start of production

Other

- Net debt/EBITDA: <3 (may be temporarily exceeded)

- Equity ratio: ~20%

Current price development

AT&S at a Glance

Unique market position

Quality leader with outstanding process know-how and excellent productivity and efficiency

Growth-oriented Strategy

Megatrend-driven markets with attractive growth potential

Addressing growth opportunities through targeted investments

Sustainable Profitability

Over the past years, AT&S consistently outperformed the printed circuit board and substrate market

EBITDA margin of 20 – 25% above industry average

Strong cash flow generation and, consequently, improved internal financing capability

Solid balance sheet and attractive dividend policy

Management board and supervisory board

In order to further expand and safeguard its excellent market position, AT&S focuses on continuity in leadership and on clear visions. Our management team, led by CEO Andreas Gerstenmayer, ensures that the company always remains in balance and targets in the areas of innovation, sustainability and expansion do not conflict with one another. More information on our management team can be found here:

You may also be interested in these topics

For years, AT&S has been pursuing a strategy of sustainable, long-term increases in the value of the company. It is expressly committed to comprehensive corporate governance.

Here you will find information on the performance of the AT&S share, basic information, shareholder structure, dividend and consensus.